Seamlessly connect payments to your business

Lipisha makes it easy for businesses to securely integrate into mobile money, card and bank channels in Africa.

Trusted by thousands of small and medium business, corporates, telcos, banks, online merchants and software developers.

Take advantage of media's most prominent business trend, and empowers your internal advertising teams.

Spend less time worrying about front-end and more focusing on your products and projects and plans.

Take advantage of media's most prominent business trend, and empowers your internal advertising teams.

Take advantage of media's most prominent business trend, and empowers your internal advertising teams.

Spend less time worrying about front-end and more focusing on your products and projects and plans.

Take advantage of media's most prominent business trend, and empowers your internal advertising teams.

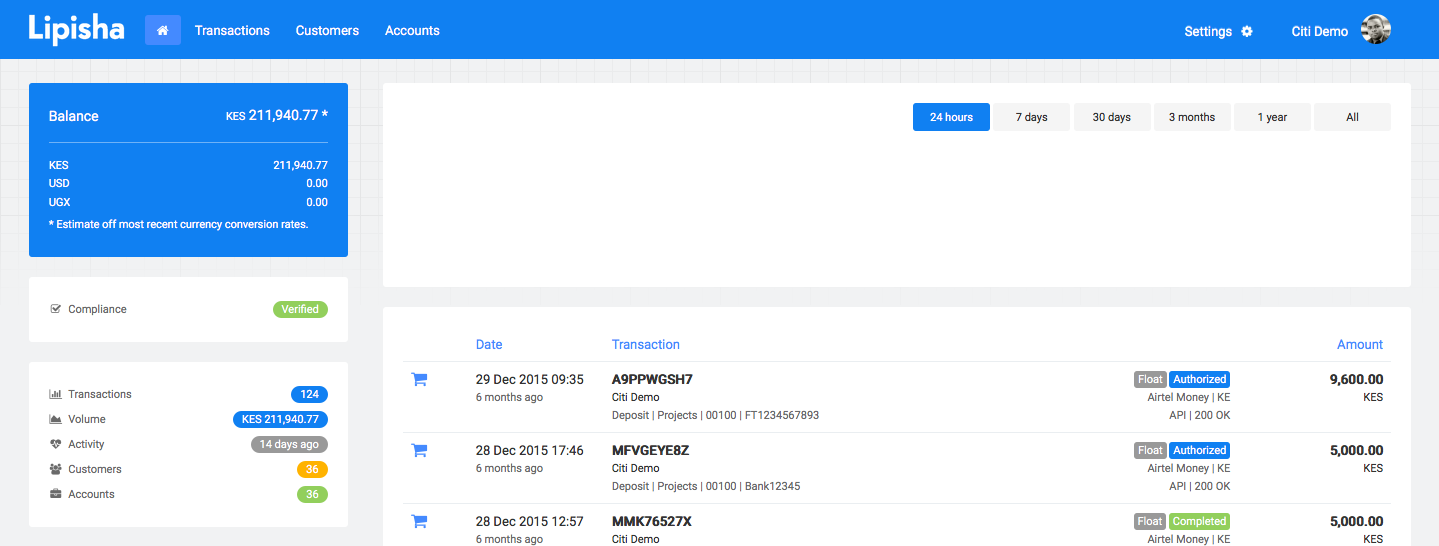

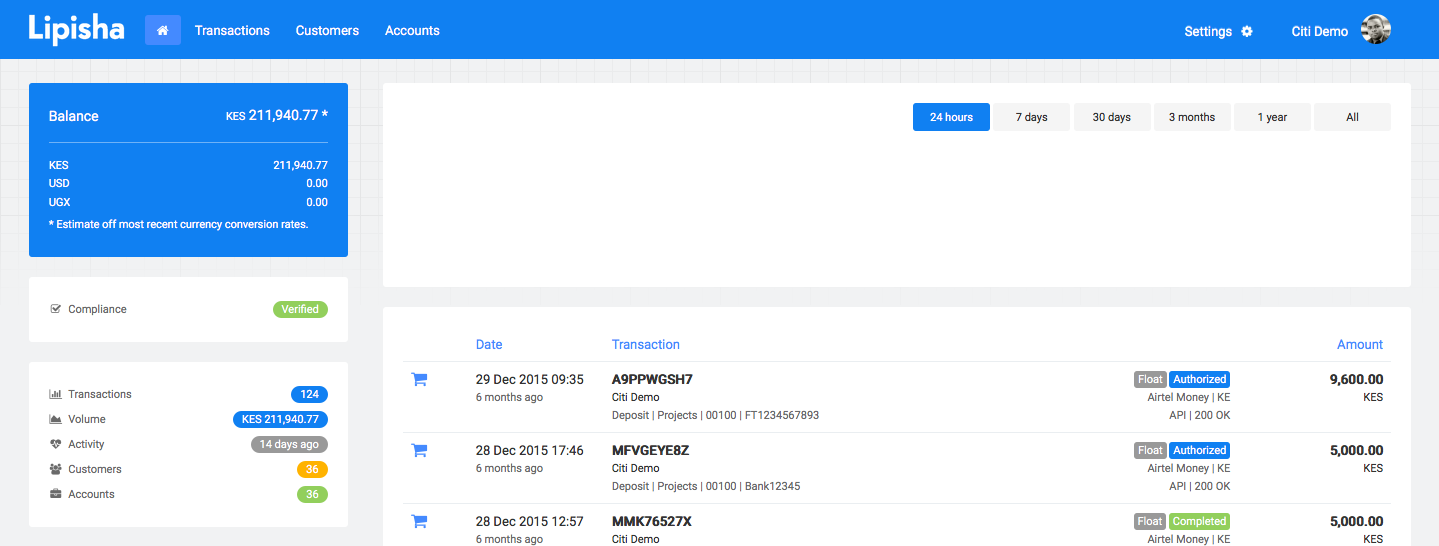

Lipisha let's you spend less time worrying about payments and more time growing sales and improving your revenue.

Lipisha seamlessly integrates with major mobile money, card, and banking platforms, simplifying payments from all your clients across various networks.

Lipisha enables you to effortlessly settle payouts to your bank or mobile mobile account instantly, or automate scheduling based on preset times or amounts.

Lipisha prioritizes payment security using high-grade encryption and anti-fraud measures while securely transmiting all data via bank-grade 256-bit HTTPS channel.

Lipisha instantly notifies you and your customer via SMS and email upon payment receipt. A printable receipt is also emailed upon payment confirmation.

Lipisha offers a comprehensive range of reports for analyzing your payments data, aiding in understanding and analyzing your business performance and trends.

Lipisha allows you to organize and search for your clients based on their transaction history, essential for effective customer management and communication.

Lipisha unifies all your payment transactions through a single interface, closing the data gap and bringing all the channels together, regardless of their sources.

Lipisha lets you control who can do what: cashiers receive payments, accountants download statements, and managers add cashiers, all with customizable access rights.

Instead of taking a percentage off your hard earned revenues, Lipisha charges a fixed monthly amount based on your use of the platform.